As How to Interpret Auto Policy Quotes: A Canadian Perspective takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Exploring the intricacies of auto policy quotes from a Canadian standpoint unveils a realm of vital information crucial for making informed decisions about insurance coverage.

Understanding Auto Policy Quotes

When it comes to interpreting auto policy quotes in Canada, it's essential to understand the key components that influence the cost of auto insurance and the various coverage options available. Let's delve into the details.

Key Components of an Auto Policy Quote

- Liability Coverage: This component covers costs associated with bodily injury and property damage in case you are at fault in an accident.

- Collision Coverage: This covers repairs to your vehicle in the event of a collision, regardless of fault.

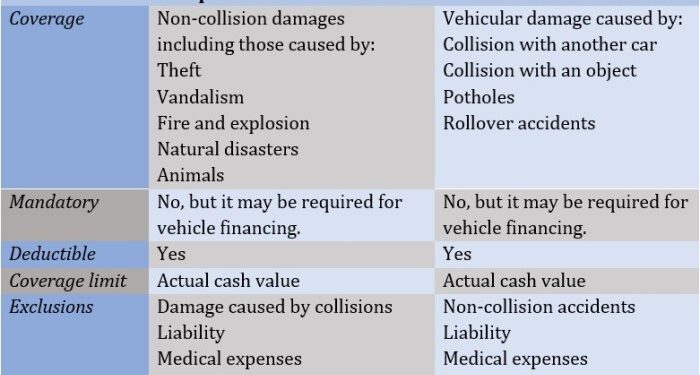

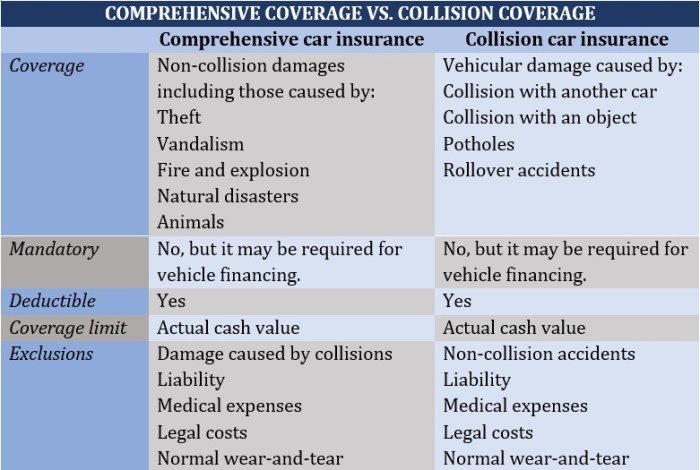

- Comprehensive Coverage: This covers damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

- Deductibles: The amount you agree to pay out of pocket before your insurance kicks in.

- Additional Coverage Options: These may include rental car coverage, roadside assistance, and more.

Factors Influencing the Cost of Auto Insurance in Canada

- Driving Record: A history of accidents or traffic violations can increase premiums.

- Age and Gender: Younger drivers and males typically pay higher premiums.

- Vehicle Type: The make, model, and age of your vehicle can affect insurance rates.

- Location: Urban areas with higher rates of accidents and theft may result in higher premiums.

- Coverage Limits: Higher coverage limits will lead to higher premiums.

Types of Coverage Options in Auto Policy Quotes

- Third-Party Liability: Covers costs if you injure someone or damage their property in an accident.

- Accident Benefits: Provides coverage for medical expenses and lost income due to injuries sustained in an accident.

- Uninsured/Underinsured Motorist: Protects you if you're in an accident with a driver who has insufficient insurance.

- Direct Compensation Property Damage: Covers damage to your vehicle when another driver is at fault.

Interpreting Coverage Limits

When it comes to auto insurance policies, coverage limits play a crucial role in determining the extent of protection you have in case of an accident or other covered event. Understanding these limits is essential in making informed decisions about your insurance coverage.Coverage limits refer to the maximum amount your insurance provider will pay out for a specific type of coverage.

These limits are typically set per policy period, and exceeding them may result in out-of-pocket expenses for you. Different types of coverage, such as liability, collision, and comprehensive, each have their own set limits.

Impact of Coverage Limits on Cost

- Higher coverage limits generally result in higher premiums, as the insurance company is taking on a greater financial risk by agreeing to pay out more in the event of a claim.

- On the other hand, opting for lower coverage limits can lead to lower premiums, but may leave you vulnerable to higher out-of-pocket expenses if the coverage limits are exceeded.

- It's important to strike a balance between adequate coverage and affordability when selecting coverage limits for your auto insurance policy.

Common Coverage Limits in Canadian Auto Policies

| Coverage Type | Common Coverage Limits |

|---|---|

| Liability | $1,000,000 per occurrence |

| Accident Benefits | $50,000 for medical expenses and income replacement |

| Collision | Actual cash value of the vehicle |

| Comprehensive | Actual cash value of the vehicle |

Deductibles and Premiums

When it comes to auto insurance, deductibles and premiums play a crucial role in determining the cost of coverage and how much you will pay out of pocket in the event of a claim. Understanding the relationship between deductibles and premiums is essential for making informed decisions about your insurance policy.

Choosing Deductible Amounts

- Higher deductibles typically result in lower premiums: By opting for a higher deductible, you are agreeing to pay more out of pocket before your insurance coverage kicks in. In return, insurance companies often reward this higher risk assumption by offering lower premium rates.

- Lower deductibles mean higher premiums: On the other hand, selecting a lower deductible will lead to higher premium costs. This is because the insurance company is taking on more risk by agreeing to cover a larger portion of the claim.

- Consider your financial situation: When choosing a deductible amount, it's important to consider your financial circumstances. While a higher deductible may save you money on premiums, you need to ensure you can afford to pay that amount if you need to make a claim.

Selecting the Right Deductible

- Evaluate your risk tolerance: If you are comfortable with assuming more risk and can afford a higher out-of-pocket expense, opting for a higher deductible may be a good choice to save on premiums.

- Assess your driving habits: Consider your driving history and the likelihood of filing a claim. If you have a clean record and drive cautiously, a higher deductible may be suitable since the chances of needing to make a claim are lower.

- Consult with your insurance provider: Talk to your insurance agent or provider to discuss your options and determine the deductible amount that aligns with your needs and budget.

Policy Exclusions and Inclusions

When it comes to interpreting auto policy quotes, understanding the policy exclusions and inclusions is crucial. Policy exclusions are specific scenarios or conditions that are not covered by the insurance policy, while policy inclusions refer to the coverage provided by the policy.

Let's delve deeper into these two aspects to better comprehend their significance.

Common Exclusions in Auto Insurance Policies

Auto insurance policies typically have certain exclusions that specify what the policy does not cover. Some common exclusions in auto insurance policies may include:

- Intentional damage or illegal activities

- Racing or using the vehicle for commercial purposes without proper coverage

- Wear and tear or mechanical failures

- Driving under the influence of drugs or alcohol

- Unlisted drivers or unauthorized use of the vehicle

Policy Inclusions and Benefits

Policy inclusions Artikel the coverage provided by the auto insurance policy, giving policyholders a sense of protection in various situations. Understanding policy inclusions is essential as they determine the extent of financial support available in case of an incident. Some key policy inclusions and their benefits may include:

- Liability coverage: Protects against legal liabilities for bodily injury or property damage

- Collision coverage: Covers damage to the insured vehicle in case of a collision

- Comprehensive coverage: Provides coverage for non-collision incidents like theft, vandalism, or natural disasters

- Uninsured/underinsured motorist coverage: Offers protection if the at-fault driver is uninsured or underinsured

Importance of Reviewing Policy Exclusions and Inclusions

Reviewing the policy exclusions and inclusions is vital when interpreting auto policy quotes as it helps policyholders understand the scope of coverage provided by the policy. By being aware of what is included and excluded, policyholders can make informed decisions about their insurance needs and ensure they have adequate protection in place.

Additional Coverage Options

Adding optional coverage add-ons to your Canadian auto policy can provide extra protection and peace of mind in various situations. These additional coverages can be tailored to your specific needs and offer financial security in the event of unexpected incidents.

Rental Car Coverage

- Rental car coverage provides reimbursement for the cost of renting a vehicle while your car is being repaired due to a covered loss.

- This coverage is beneficial if you rely on your vehicle for daily activities and cannot afford to be without transportation.

- For example, if your car is in the shop for repairs after an accident, rental car coverage can help cover the cost of a temporary replacement vehicle.

Roadside Assistance

- Roadside assistance coverage offers services such as towing, fuel delivery, lockout assistance, and tire changes in case of a breakdown or emergency.

- Having roadside assistance can provide peace of mind and ensure you're not stranded on the side of the road in case of unexpected car trouble.

- For instance, if your car breaks down on a deserted road, roadside assistance coverage can help you get back on the road safely.

Accident Forgiveness

- Accident forgiveness coverage protects your driving record by preventing your insurance rates from increasing after your first at-fault accident.

- This coverage can be valuable in maintaining affordable insurance premiums and avoiding financial penalties for a simple mistake.

- For example, if you have accident forgiveness and get into a minor fender bender, your rates may not go up as a result.

Closure

In conclusion, How to Interpret Auto Policy Quotes: A Canadian Perspective delves deep into the nuances of insurance quotes, providing readers with valuable insights to navigate the complex world of auto insurance policies with confidence.

FAQ Summary

What are the key components of an auto policy quote?

Auto policy quotes typically include information about coverage limits, deductibles, premiums, and additional coverage options.

How do coverage limits impact the cost of auto insurance?

Coverage limits determine the maximum amount an insurance company will pay for a claim, affecting the overall cost of insurance premiums.

What are some common exclusions in auto insurance policies?

Common exclusions may include pre-existing conditions, intentional acts, and certain types of damage not covered by the policy.

Why is it important to review policy inclusions and exclusions?

Reviewing policy inclusions and exclusions helps policyholders understand what is covered and what is not, ensuring they have adequate protection.

What are some optional coverage add-ons available in Canadian auto policies?

Optional coverage add-ons may include rental car coverage, roadside assistance, and comprehensive coverage for specific perils.