Navigating the world of auto insurance can be overwhelming, especially when it comes to comparing policy quotes. Understanding the nuances of different quotes is crucial in making an informed decision. This guide delves into the intricacies of comparing auto policy quotes effectively in the USA, providing valuable insights and tips for consumers.

As we delve deeper into the details, you'll discover key factors to consider, tips on researching insurance providers, and strategies for seeking discounts. By the end, you'll be equipped with the knowledge to make well-informed decisions about your auto insurance coverage.

Understanding Auto Policy Quotes

When it comes to auto insurance, understanding policy quotes is crucial for making informed decisions. Auto policy quotes are estimates provided by insurance companies that Artikel the coverage options and premium costs for a specific policy.

Components of Auto Policy Quotes

- The coverage types included, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- The limits and deductibles for each coverage type.

- Any additional features or riders offered, like roadside assistance or rental car reimbursement.

- The total premium amount and payment schedule.

Importance of Comparing Auto Policy Quotes

Comparing auto policy quotes effectively allows you to find the best coverage for your needs at a competitive price. By reviewing multiple quotes, you can identify differences in coverage, limits, and costs to make an informed decision.

Significance of Understanding Auto Policy Quotes

- Prevents surprises: Understanding the details of auto policy quotes helps you avoid unexpected expenses or coverage gaps.

- Empowers decision-making: Knowledge of policy quotes enables you to select the right coverage options for your budget and protection needs.

- Avoids overpaying: By comprehending auto policy quotes, you can avoid paying for unnecessary coverage or inflated premiums.

Factors to Consider

When comparing auto policy quotes, there are several key factors to consider that can impact the cost and coverage of your policy. Understanding these factors can help you make an informed decision that meets your needs and budget.

Coverage Limits Impact

- Policy quotes can vary based on the coverage limits you choose. Higher coverage limits typically result in higher premiums, but provide more protection in case of an accident or other event.

- It's important to evaluate your individual needs and risks to determine the appropriate coverage limits for your auto policy.

- Consider factors such as the value of your vehicle, your driving habits, and potential risks on the road when selecting coverage limits.

Role of Deductibles

- Deductibles play a significant role in determining the cost of auto policies. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in.

- Choosing a higher deductible can lower your premium, but also means you will have to pay more in the event of a claim. On the other hand, a lower deductible results in higher premiums but less out-of-pocket expenses when making a claim.

- Consider your financial situation and risk tolerance when deciding on a deductible amount for your auto policy.

Impact of Personal Details

- Personal details such as age, driving record, and location can significantly affect policy quotes. Younger drivers or those with a history of accidents or traffic violations may face higher premiums.

- Insurance companies use personal details to assess risk and determine the likelihood of claims. Maintaining a clean driving record and being a responsible driver can help lower your auto policy quotes.

- It's important to provide accurate and up-to-date personal information when requesting auto policy quotes to ensure you receive accurate pricing based on your individual circumstances.

Researching Insurance Providers

When comparing auto policy quotes, it is crucial to research the insurance providers offering these quotes. Here are some tips to help you make an informed decision:

Checking Financial Stability and Reputation

Before choosing an insurance provider, it is essential to check their financial stability and reputation. A financially stable company is more likely to honor claims and provide reliable service. You can look up the financial ratings of insurance companies from rating agencies like A.M.

Best, Standard & Poor's, or Moody's.

Customer Reviews and Ratings

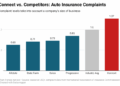

Reading customer reviews and ratings can give you valuable insights into the quality of service provided by insurance companies. Look for feedback on customer service, claims processing, and overall satisfaction. Websites like J.D. Power and Consumer Reports can be helpful resources for finding customer reviews.

Verifying Legitimacy of Insurance Companies

It is crucial to verify the legitimacy of insurance companies offering quotes. You can check if the company is licensed to sell insurance in your state by contacting your state's insurance department. Additionally, you can look up the company's history of complaints and regulatory actions on the National Association of Insurance Commissioners (NAIC) website.

Comparing Policy Quotes

When comparing policy quotes for auto insurance, it's essential to carefully analyze the details provided by different insurance providers. This involves looking at coverage options, deductibles, premiums, and any hidden costs or exclusions that may impact the overall value of the policy.

Analyzing Coverage Details

Before making a decision, review the coverage options offered by each insurance provider. Look for key elements such as liability coverage, comprehensive coverage, collision coverage, uninsured motorist protection, and any additional perks or benefits included in the policy

Comparing Deductibles and Premiums

Compare the deductibles and premiums across different policy quotes to determine the cost of the policy and how much you would have to pay out of pocket in the event of a claim. Keep in mind that a higher deductible usually results in a lower premium, but it also means you'll have to pay more if you need to file a claim.

Identifying Hidden Costs or Exclusions

Be vigilant in identifying any hidden costs or exclusions in policy quotes. Look for clauses that may limit coverage or add unexpected fees. Pay attention to exclusions related to specific incidents or types of damage that may not be covered under the policy.

Seeking Discounts and Special Offers

When comparing auto policy quotes, seeking discounts and special offers can significantly impact the overall cost of insurance. Insurance providers often offer various discounts to attract customers and retain their business. Knowing how to inquire about available discounts and understanding the impact of bundling policies or having a good driving record can help you make informed decisions when comparing quotes.

Common Discounts Offered by Insurance Providers

- Multi-policy discount: This discount is applied when you bundle multiple insurance policies, such as auto and home insurance, with the same provider.

- Good driver discount: Insurance companies offer lower rates to drivers with a clean driving record, free of accidents or traffic violations.

- Good student discount: Students who maintain good grades may qualify for a discount on their auto insurance premiums.

- Affiliation discounts: Some insurance companies offer discounts to members of certain organizations or alumni associations.

Tips on Inquiring About Available Discounts

- Ask directly: When requesting policy quotes, inquire about any available discounts or special offers that you may qualify for.

- Provide necessary information: Be prepared to provide details such as driving history, academic records, or affiliations that may make you eligible for discounts.

- Compare discount rates: Take note of the percentage or amount of discount offered by different insurance providers to make a more informed decision.

Impact of Bundling Policies and Good Driving Record

Bundling policies with the same insurance provider can lead to significant discounts on premiums, while maintaining a good driving record can result in lower rates due to reduced risk for the insurer.

Factoring in Discounts and Special Offers

- Consider the total savings: Calculate the total cost of insurance after applying discounts to see which policy offers the best value.

- Compare final prices: Compare the final premiums of different policies, factoring in all available discounts and special offers to make an informed decision.

Making Informed Decisions

When selecting an auto policy, it is crucial to make informed decisions to ensure you have the right coverage for your needs. Prioritizing factors, understanding the trade-offs between lower premiums and higher coverage, reviewing policy terms, and seeking clarifications are all essential steps in the decision-making process.

Factors to Prioritize When Selecting an Auto Policy

- Consider your driving habits and the level of coverage you need based on your vehicle type.

- Evaluate the financial stability and reputation of the insurance provider.

- Assess the deductible amount and how it affects your premium and out-of-pocket expenses.

Choosing Between Lower Premium and Higher Coverage

- Balance between affordability and sufficient coverage to protect yourself financially in case of an accident.

- Consider factors like your driving record, the value of your vehicle, and your risk tolerance when deciding on coverage limits.

- Review the different types of coverage options available and choose what aligns best with your needs.

Importance of Reviewing Policy Terms and Conditions

- Understand the specifics of your policy, including coverage limits, exclusions, and conditions that may impact your claims.

- Be aware of any restrictions or requirements set by the insurance provider to avoid potential issues in the future.

- Review the renewal process, cancellation policies, and any potential penalties for early termination.

Requesting Clarifications or Additional Information

- Reach out to the insurance provider for clarification on any confusing terms or coverage details.

- Ask about any discounts or special offers that may apply to your policy to maximize savings.

- Seek guidance on how to make changes to your policy or update your coverage as needed.

Ending Remarks

In conclusion, mastering the art of comparing auto policy quotes effectively can lead to substantial savings and better coverage. By following the steps Artikeld in this guide, you'll be well on your way to securing the right auto insurance policy for your needs.

Stay informed, stay protected.

Key Questions Answered

How do I know which insurance provider is the most reliable?

Researching the financial stability and reputation of insurance companies can help gauge their reliability. Check customer reviews and ratings for additional insights.

What discounts are commonly offered by insurance providers?

Common discounts include multi-policy, safe driver, and good student discounts. Inquire about these when comparing policy quotes.

What should I prioritize when selecting an auto policy?

Consider factors like coverage limits, deductibles, and premiums based on your needs. Balance between cost and coverage to find the right policy.

How can I identify hidden costs in policy quotes?

Carefully review the coverage details for any exclusions or additional fees. Compare deductibles and premiums across quotes to uncover hidden costs.

Is it better to choose a lower premium or higher coverage?

The decision depends on your budget and risk tolerance. Evaluate your needs and financial situation to determine the best balance between premium and coverage.