Exploring Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada, this introduction sets the stage for an informative discussion on navigating the complexities of insurance for high-risk drivers in a clear and engaging manner.

The following paragraph will delve deeper into the intricacies of the topic, offering valuable insights and practical advice for those seeking affordable car insurance solutions in Canada.

Understanding High-Risk Drivers in Canada

High-risk drivers in Canada are individuals who insurance companies consider more likely to get into accidents or file claims, leading to higher costs for the insurer. This classification is based on several factors that signal a higher likelihood of accidents or claims, making it challenging for these drivers to secure affordable car insurance.

Factors Contributing to High-Risk Driver Classification

- Prior traffic violations: Drivers with a history of speeding tickets, DUI convictions, or at-fault accidents are often deemed high risk.

- Lack of driving experience: New drivers, especially young ones, may face higher premiums due to their limited experience on the road.

- Low credit score: Insurers may view individuals with poor credit scores as less responsible, potentially leading to higher premiums.

- Driving record: A history of insurance claims or driving infractions can also contribute to a driver being categorized as high risk.

Tips for High-Risk Drivers to Obtain Discount Car Insurance Quotes

Being classified as a high-risk driver in Canada can lead to higher insurance premiums. However, there are strategies you can use to lower your insurance costs and obtain discount car insurance quotes.

Identify strategies high-risk drivers can use to lower their insurance premiums

- Consider taking a defensive driving course to improve your skills and demonstrate your commitment to safe driving.

- Opt for a higher deductible to lower your premium, but make sure you can afford the out-of-pocket expenses in case of a claim.

- Bundle your car insurance with other policies, such as home or renters insurance, to qualify for multi-policy discounts.

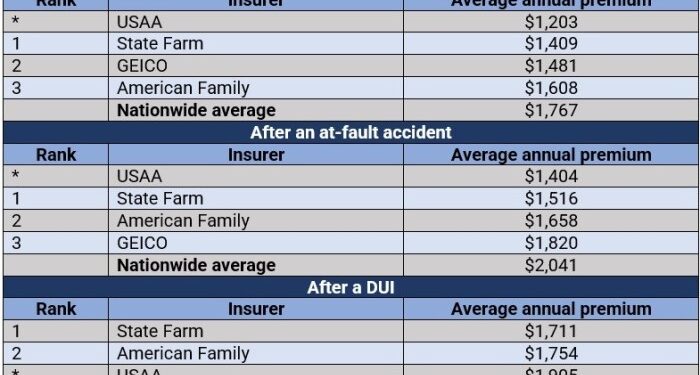

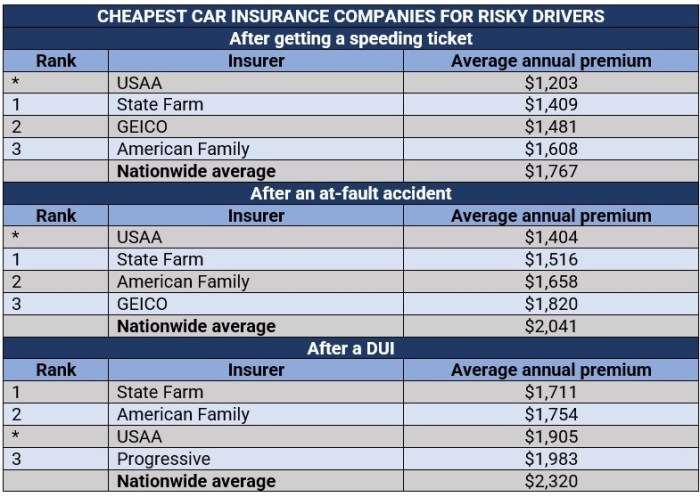

Compare different insurance companies that offer discounts for high-risk drivers in Canada

- Research and compare quotes from several insurance companies to find the best rates for high-risk drivers.

- Look for insurance companies that specialize in providing coverage for high-risk drivers, as they may offer more competitive rates.

- Consider factors like customer service, coverage options, and discounts offered when choosing an insurance provider.

Detail the importance of maintaining a good driving record for obtaining discounts

Insurance companies often reward safe driving habits with discounts on premiums. By maintaining a good driving record, you can demonstrate to insurers that you are a responsible driver and potentially qualify for lower rates. Avoiding traffic violations and accidents can help you secure discount car insurance quotes as a high-risk driver

Available Discounts and Programs for High-Risk Drivers

High-risk drivers in Canada may face challenges when it comes to obtaining affordable car insurance. However, there are discounts and programs specifically designed to help these individuals save on their insurance premiums.Completing defensive driving courses can be beneficial for high-risk drivers as it demonstrates a commitment to safe driving practices.

Many insurance companies offer discounts to drivers who have completed these courses, as they are seen as less risky to insure.

Common Discounts for High-Risk Drivers

- Multi-policy discounts for bundling car insurance with other types of insurance

- Low-mileage discounts for drivers who do not use their vehicles frequently

- Pay-as-you-drive programs that base premiums on actual driving habits

Government Initiatives for High-Risk Drivers

- The Facility Association, a non-profit organization, provides auto insurance to high-risk drivers who are unable to obtain coverage in the regular market

- Provincial government programs that offer financial assistance to eligible high-risk drivers

- Subsidized insurance programs for low-income drivers who may be considered high-risk

Factors Impacting Car Insurance Rates for High-Risk Drivers

When it comes to high-risk drivers in Canada, several factors play a crucial role in determining their car insurance rates. From age and driving experience to the type of vehicle they drive and their past claims history, these factors can significantly impact the premiums they pay.

Age and Driving Experience

Age and driving experience are key factors that insurance companies consider when determining rates for high-risk drivers. Younger and less experienced drivers are often charged higher premiums due to their increased likelihood of being involved in accidents. As drivers gain more experience and reach a certain age, insurance rates typically decrease.

Vehicle Type and Usage

The type of vehicle a high-risk driver owns and how they use it also affect insurance premiums. Vehicles with high horsepower or that are more expensive to repair or replace may result in higher insurance costs. Additionally, if a driver uses their vehicle for business purposes or long commutes, they may face higher premiums due to increased risk.

Past Claims and Violations

Past claims and driving violations can have a significant impact on car insurance rates for high-risk drivers. Drivers with a history of accidents or traffic violations are considered riskier to insure, leading to higher premiums. Insurance companies take into account the frequency and severity of past claims and violations when calculating rates for high-risk drivers.

Summary

In conclusion, this comprehensive guide has shed light on the nuances of obtaining discount car insurance quotes for high-risk drivers in Canada, empowering individuals to make informed decisions and secure suitable coverage for their needs.

Questions and Answers

What factors contribute to being labeled a high-risk driver?

Being labeled a high-risk driver can result from factors such as a history of accidents, traffic violations, or DUI convictions.

How can high-risk drivers lower their insurance premiums?

High-risk drivers can lower premiums by improving their driving record, choosing a car with safety features, and comparing quotes from different insurers.

Are there specific programs for high-risk drivers in Canada?

Yes, there are programs like defensive driving courses that can help high-risk drivers qualify for discounts on their insurance premiums.