Embark on a journey through the world of car insurance in Canada with the ultimate checklist for shopping online. Discover the tips and tricks to find the best coverage that suits your needs.

Understanding the Importance of Shopping for Car Insurance Online

Shopping for car insurance online offers numerous benefits for Canadians, making it a convenient and efficient way to find the best coverage at competitive rates.

Key Advantages of Comparing Car Insurance Quotes Online

- Access to Multiple Quotes: By shopping online, Canadians can easily compare quotes from various insurance providers in one place, helping them find the most affordable option.

- Time-Saving: Online platforms allow users to quickly input their information and receive instant quotes, eliminating the need to contact multiple insurance companies individually.

- Transparent Information: Online tools provide detailed information about coverage options, policy features, and pricing, enabling consumers to make informed decisions.

- Customization: Online platforms allow users to customize their coverage preferences and adjust deductibles to see how they impact the overall cost, helping them tailor a policy to their needs.

Convenience of Shopping for Car Insurance Quotes Online

- 24/7 Availability: Online platforms are accessible at any time, allowing consumers to compare quotes and purchase insurance at their convenience, without being restricted by office hours.

- Easy Comparison: With all the information available online, consumers can easily compare coverage options, prices, and policy features to find the best fit for their budget and needs.

- No Pressure Sales Tactics: Shopping online eliminates the pressure of sales agents, allowing consumers to review quotes at their own pace and make decisions without feeling rushed or coerced.

Factors to Consider When Shopping for Car Insurance Quotes Online

When shopping for car insurance quotes online in Canada, there are several important factors to consider to ensure you are getting the best coverage at the right price.

Essential Factors to Consider

- Policy Coverage: Review the coverage options offered by different insurance companies to ensure they meet your needs. Consider factors such as liability coverage, collision coverage, comprehensive coverage, and any additional riders or endorsements.

- Premium Costs: Compare the premium costs from different insurance providers to find the most competitive rates. Keep in mind that the cheapest option may not always provide the best coverage.

- Deductibles: Evaluate the deductibles associated with each policy. A higher deductible typically means lower premiums, but you will have to pay more out of pocket in the event of a claim.

- Discounts: Look for any discounts or incentives offered by insurance companies that can help lower your overall premium. Common discounts include safe driver discounts, multi-policy discounts, and good student discounts.

Importance of Reviewing Insurance Company Reputation

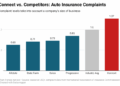

When shopping for car insurance quotes online, it is crucial to review the reputation of the insurance companies you are considering. A company's reputation can provide insight into their customer service, claims handling process, and overall reliability.

Choosing an insurance provider with a solid reputation can give you peace of mind knowing that they will be there for you when you need them most.

Navigating Different Types of Car Insurance Coverage Online

When shopping for car insurance online, it's crucial to understand the various types of coverage available in Canada to make an informed decision that suits your needs.

Comprehensive Coverage

Comprehensive coverage provides protection for damages to your vehicle that are not caused by a collision. This can include theft, vandalism, weather-related incidents, and more.

- Provides coverage for non-collision related damages

- Offers a higher level of protection for your vehicle

- May include additional benefits like rental car coverage

Collision Coverage

Collision coverage helps pay for damages to your vehicle resulting from a collision with another vehicle or object. This type of coverage is particularly beneficial if you have a new or valuable car.

- Covers damages from collisions with other vehicles or objects

- Helps repair or replace your vehicle in case of an accident

- Can be essential for newer vehicles with higher value

Liability Coverage

Liability coverage is essential for covering damages or injuries you may cause to others in an accident. This type of coverage is mandatory in Canada and helps protect you financially in case of a lawsuit.

- Protects you from financial responsibility for causing harm to others

- Includes coverage for legal fees and medical expenses of others

- Required by law in Canada to drive a vehicle

Utilizing Online Tools for Comparing Car Insurance Quotes

When shopping for car insurance online, utilizing the available online tools can help you make more informed decisions and find the best coverage at the right price. Online tools can simplify the process of comparing car insurance quotes from different providers, saving you time and money.

Online Calculators for Estimating Insurance Premiums

Many insurance websites offer online calculators that can help you estimate your insurance premiums based on factors such as your age, driving history, and the type of coverage you need. By entering relevant information into these calculators, you can get an idea of how much you might expect to pay for car insurance from various providers.

Using Comparison Websites Effectively

Comparison websites are valuable tools for quickly and easily comparing car insurance quotes from multiple providers. To use these websites effectively, follow these tips:

- Enter accurate information: Provide correct details about your driving history, vehicle, and coverage needs to get accurate quotes.

- Compare coverage options: Consider not only the price but also the coverage options offered by each provider to ensure you're getting the protection you need.

- Check customer reviews: Look for feedback from other customers to gauge the quality of service provided by each insurance company.

- Review discounts: Take note of any discounts or special offers that could help lower your insurance premiums.

Conclusive Thoughts

As we conclude our exploration of shopping for car insurance quotes online in Canada, remember to utilize the checklist to make informed decisions and secure the ideal coverage for your vehicle.

Key Questions Answered

What are the key advantages of comparing car insurance quotes online?

Comparing quotes online allows you to easily find the best rates and coverage options tailored to your needs, saving you time and money.

How do I determine the right type of coverage when shopping online?

Consider factors like your driving habits, the value of your vehicle, and your budget to determine the most suitable coverage for your specific needs.

What online tools can I use to compare car insurance quotes effectively?

Online calculators and comparison websites are valuable tools to estimate premiums and compare different insurance options efficiently.